The Indian market closed in the green for the second straight day on April 28, which helped the Sensex climb above 32,000 and the Nifty reclaim 9,300 levels, a shade below its crucial resistance level of 9,400.

The Sensex closed the day with a gain of 1.17 percent at 32,114.52 and the Nifty settled 1.06 percent higher at 9,380.90.

The Nifty failed to hold on to the 9,400 level but closed near its strong opening levels and formed a Dragonfly Doji pattern on the daily charts.

A Dragonfly Doji pattern signals indecision among traders but also indicates that the bulls managed to bring the index close to the opening level. The index has to clear the immediate hurdle of 9,400 for bullish sentiment to continue.

The Indian market closed in the green for the second straight day on April 28, which helped the Sensex climb above 32,000 and the Nifty reclaim 9,300 levels, a shade below its crucial resistance level of 9,400.

The Sensex closed the day with a gain of 1.17 percent at 32,114.52 and the Nifty settled 1.06 percent higher at 9,380.90.

The Nifty failed to hold on to the 9,400 level but closed near its strong opening levels and formed a Dragonfly Doji pattern on the daily charts.

A Dragonfly Doji pattern signals indecision among traders but also indicates that the bulls managed to bring the index close to the opening level. The index has to clear the immediate hurdle of 9,400 for bullish sentiment to continue.

Call unwinding was witnessed at 9,300, which shed 2.9 lakh contracts, followed by 9,200 strikes, which shed 1.97 lakh contracts.

Put option data

Maximum put OI of 33.33 lakh contracts was seen at 9,000 strikes, which will act as crucial support in the April series.

This is followed by 9,300, which holds 20.13 lakh contracts, and 9,200 strikes, which has accumulated 17.09 lakh contracts.

Significant Put writing was seen at 9,300, which added 9.63 lakh contracts, followed by 9,400 strikes, which added 5.72 lakh contracts.

Put unwinding was seen at 9,100, which shed 45,375 contracts, followed by 9,600 strikes that shed 16,950 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

37 stocks saw the long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

42 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

15 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

52 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

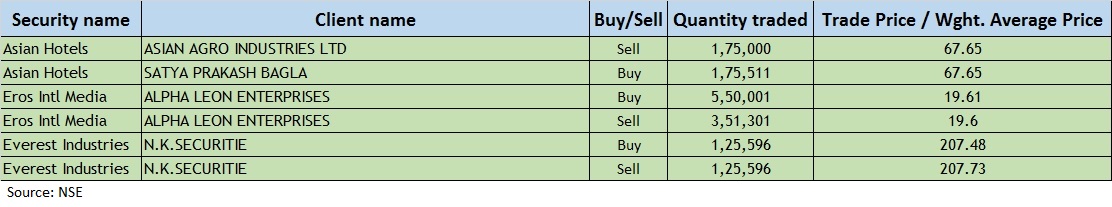

Bulk deals

Comments

Post a Comment