Jio Platforms has now raised a massive Rs 60,596 crore from leading technology investors in less than three weeks

Highlights

- Vista Equity Partners completes a hat-trick of deals for Jio with Rs 11,367 crore infusion- Jio Platforms has raised ₹ 60,596 crores from leading technology investors so far

- Helps re-rates Jio; Jio commands 32 percent of the market share of subscribers now

- Accelerates deleveraging efforts; on track to become zero debt company

- Recent corporate announcements create huge value for RIL shareholders

Global technology investors have warmed up to the idea of Jio as a platform company, as it attracts its third deal in a span of three weeks, that too in a globally depressed market. While back to back deals continue to re-rate Jio and RIL, the strong interest confirms not merely the platform’s potential but also the zero-debt target for the group company.

Within three weeks of announcing its first Jio-Facebook deal, today a third deal came to fruition with Vista Equity Partners, a software and technology investor. Vista Equity Partners – a leading investment firm for technology-enabled companies-- decided to invest Rs11,367 crore in Jio Platforms for an equity stake of 2.32 percent. This assigns an equity value of Rs4.91 lakh crore and an enterprise value of Rs5.16 lakh crore and represents a similar valuation as the Silver Lake investment. Jio Platforms has now raised a massive Rs60,596.37 crore from leading technology investors in less than three weeks.

The premium valuation given by recent investment deals by marquee investors indicates that there is significant growth potential in the business in the near future. The deal is expected to help the company to reduce its net debt and add to efforts to become a zero net debt company by March 2021. In a short span, Jio has had interest and investment from a global network media leader, a private equity giant, and now an investment firm that focuses on enterprise software, data, and technology-enabled companies.

Vista has more than $57 billion in cumulative capital commitments and its global network of companies collectively represents the 5th largest enterprise software company in the world.

Jio Platform attracting marquee investors, further rerating continues

Jio has established itself as a formidable player in the telecom industry in the last three and a half years. Jio achieved the feat on the back of its price centric strategy, which worked very well to capture the lion’s share of the market. This is evident from the fact that Jio now commands 32 percent of market share in terms of subscriber base, leaving behind both Bharti Airtel and Vodafone-Idea.

What has changed now for the industry is the trend in ARPU (Average Revenue Per User). ARPU had been trending down due to Reliance Jio’s (Jio) price-centric strategy to capture market share. But it has bottomed out now. With the competition trying to survive with massive debt on their books, the brutal price war is waning and companies have begun hiking prices, including Jio. That is why Bharti Airtel registered a 29.8 percent (year-on-year) increase in ARPU for India business in Q3 FY20 and Jio registered a growth of 3.5 percent in Q4 FY20.

Jio continues to maintain its mojo and beat expectations in its quarterly performance. It witnessed a strong topline growth and a significant margin expansion in Q4 FY20. During the quarter, Jio saw a year-on-year (YoY) growth of 3.5 percent in its ARPU (average revenue per user), driven by price hikes taken by the company in the previous quarter. Its earnings before interest, tax, depreciation, and amortization (EBITDA) margin expanded a huge 484.7 basis points year-on-year in the quarter gone by. The expansion was driven by higher ARPU, operating leverage, and cost-efficiency.

De-leveraging – the re-rating trigger

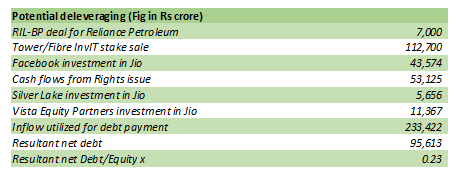

The Vista Equity Partners announcement adds one more deal to the series of deleveraging steps in the recent past. In the recent quarterly result, the company mentioned that in the current quarter (Q1 FY21) it should be able to raise Rs 104,000 crore on account of the rights issue, Facebook investment, and the earlier investment by BP. Deals from Silver Lake and Vista Equity Partners add Rs 17,023 crore to the cash flows which we assume would be utilized for debt repayment.

In such a scenario, even if we don’t account for the Aramco deal (i.e 20 percent stake in Oil/Chem business), the company’s debt to equity ratio should reduce from 0.71x to 0.23x.

How do all the pieces add up for RIL shareholders?

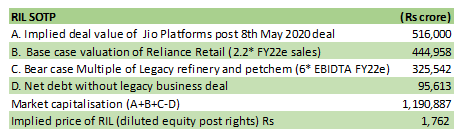

Assuming no further rerating of Jio Platforms beyond today’s deal valuation (a conservative call given the growth potential of this business magnified by the Covid-19 crisis that will only lead to further adoption of technology), a modest valuation of the retail business (50 percent discount to Amazon’s valuation), and taking the bear case valuation of the legacy refinery and petrochemical business and net debt without considering the possible Saudi Aramco deal, we arrive at a market capitalization of Rs 11.90 lakh crore. (Market cap Rs 9.5 lakh crore on 7th May 2020).

There is significant upside to these estimates as Jio Platforms might continue to attract investors at a steep premium in future, Reliance Retail can be a formidable retail giant commanding a premium, and the legacy business too can command a better multiple once the COVID scare settles. Thus the initiatives so far have created huge value for RIL shareholders.

For more research articles, Subscribe our Blog

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust, which controls Network18 Media & Investments Ltd.

Comments

Post a Comment